In today’s digital economy, businesses expect to get paid quickly and securely. And they don’t expect it to cost a lot of money. (Yes, the irony.) But the reality is very different. Especially for companies doing business internationally.

In a recent survey of more than 300 finance leaders in mid-market businesses, 55% say they lose 4-5% in revenue per month due to inefficiencies in their payment processing. The amount lost is between 6-10% of revenues for 23% of these surveyed. These costs include high wire fees, processing fees and various opaque banking fees. In fact, 89% say they have too much bandwidth tied up in receiving payments. And 90% say the complexities of collecting cross-border payments impacts their ability to grow internationally.

At Flywire, we see these problems every day. The combination of our proprietary global payment network, next-gen payments platform and vertical-specific software are specifically designed to help businesses selling internationally reduce their cost of getting paid, increase their operational efficiency, and increase customer satisfaction. But regardless of whether you are interested in using Flywire or not, it’s important to understand why it costs so much to get paid and how you can reduce those costs. The Flywire calculator example below will help you understand it better.

Introducing Jones Tech International

Meet Jones Tech International, a fictional software company with a rapidly growing international customer base. As the company’s international revenues have grown, its payment costs have risen too – at an alarming rate.

Jones Tech, or JTI, uses a standard merchant solution to accept all credit card payments, regardless of origin. The company also accepts wire transfers from international customers. There are fees associated with both.

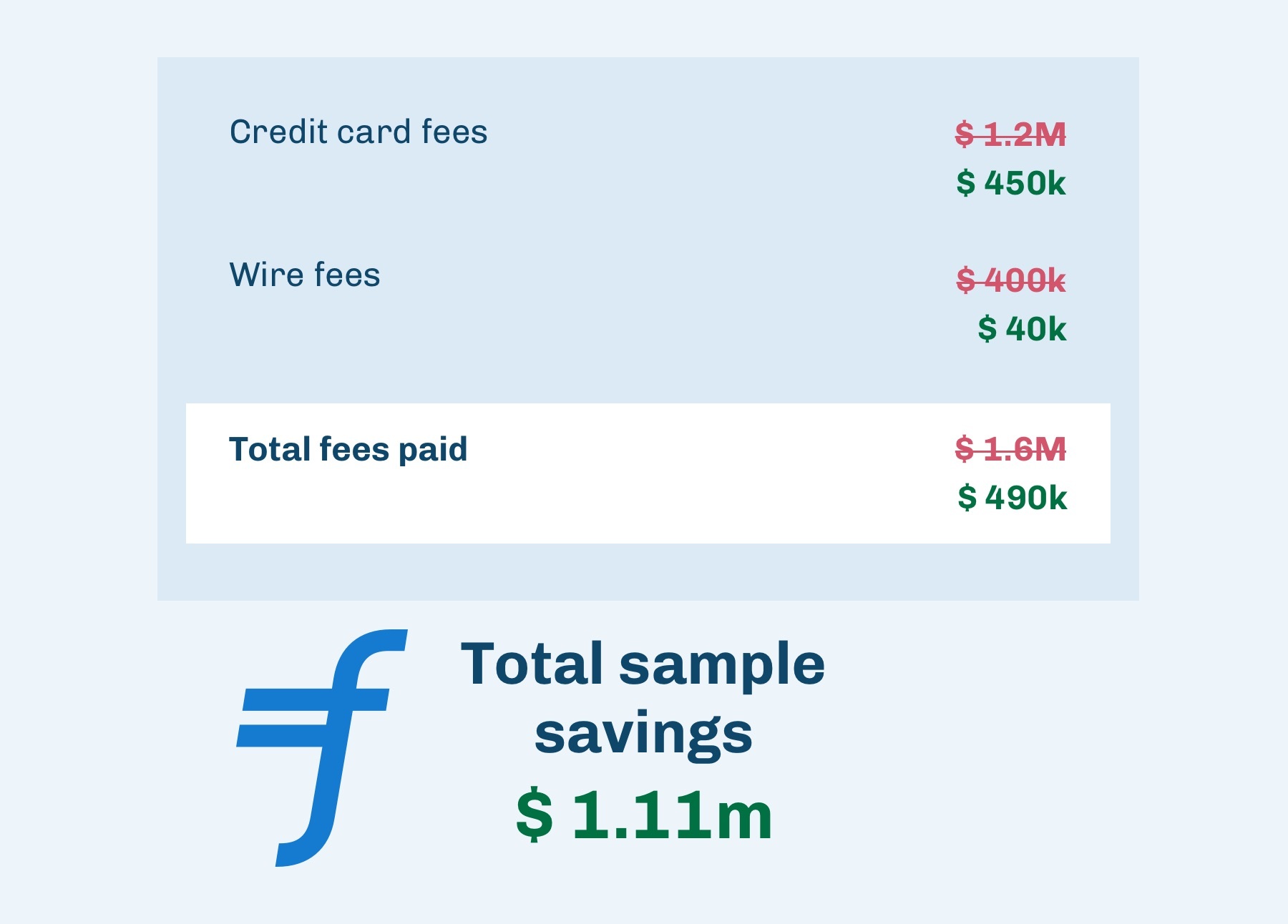

Below, we’ll look at what a company such as JTI might be paying in payment fees today, based on typical rates and pricing. Then we’ll look at how much they could potentially save with Flywire. While this is just an example of what one company might experience, these savings are typical for Flywire clients. To get an estimate of your own potential savings, request a demo.

Without Flywire

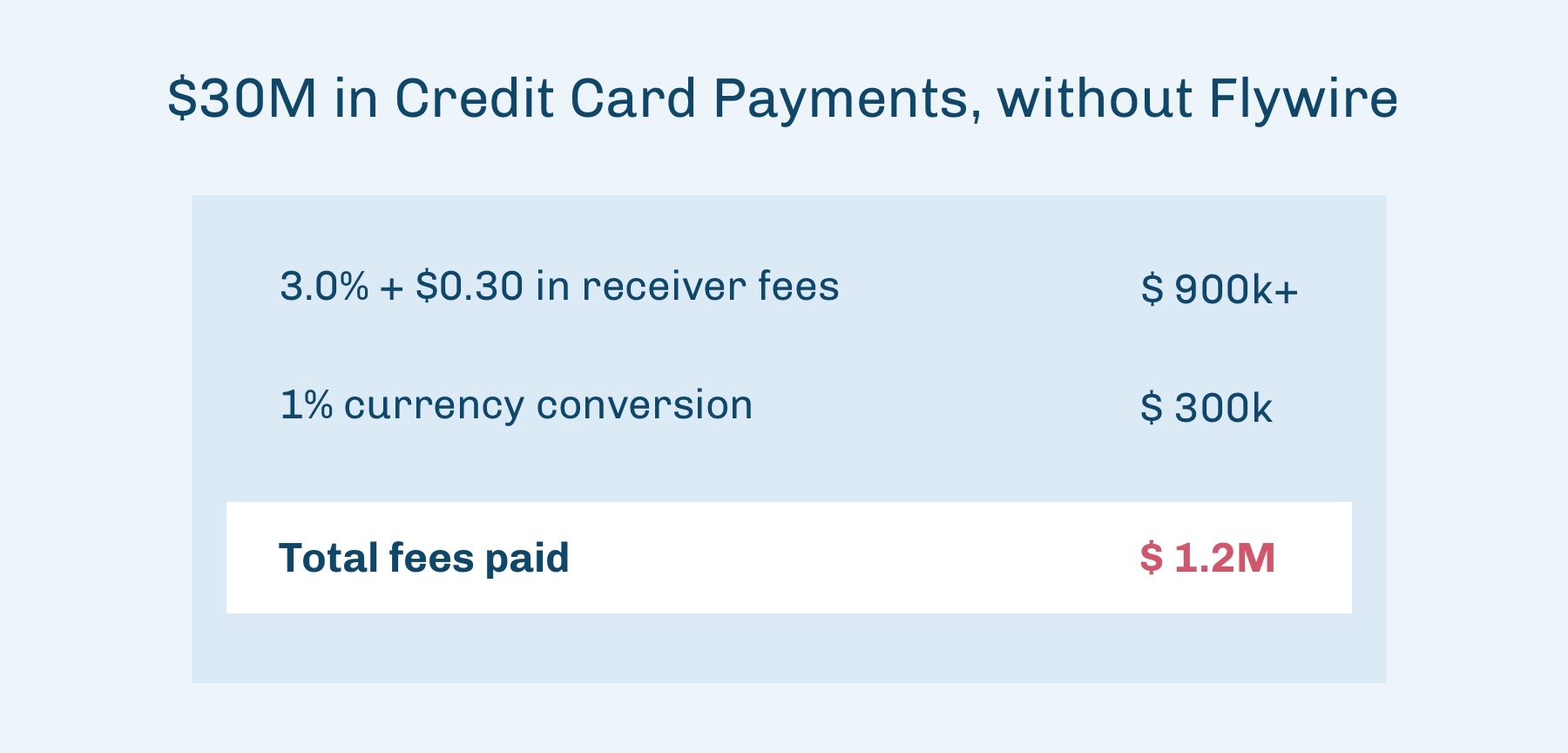

Prior to using Flywire, JTI was using a standard merchant solution to accept credit card payments. For such solutions, there are multiple fees involved when processing an international client’s credit card. The first is the merchant/receiver fee, which is typically a percentage, plus a fixed fee (e.g. 3% + .30 per transaction). If currency conversion is required, additional fees (typically around 1%) often apply.

Credit card fees for JTI’s international receivables might look like this:

In addition to the above, there is also a payer/cardholder fee, sometimes called a cross-currency charge or foreign transaction fee. This fee is generally a mark-up on the foreign exchange rate, typically about 3%. The customer won't know the true cost until they receive their monthly statement, which can result in some unhappy customers.

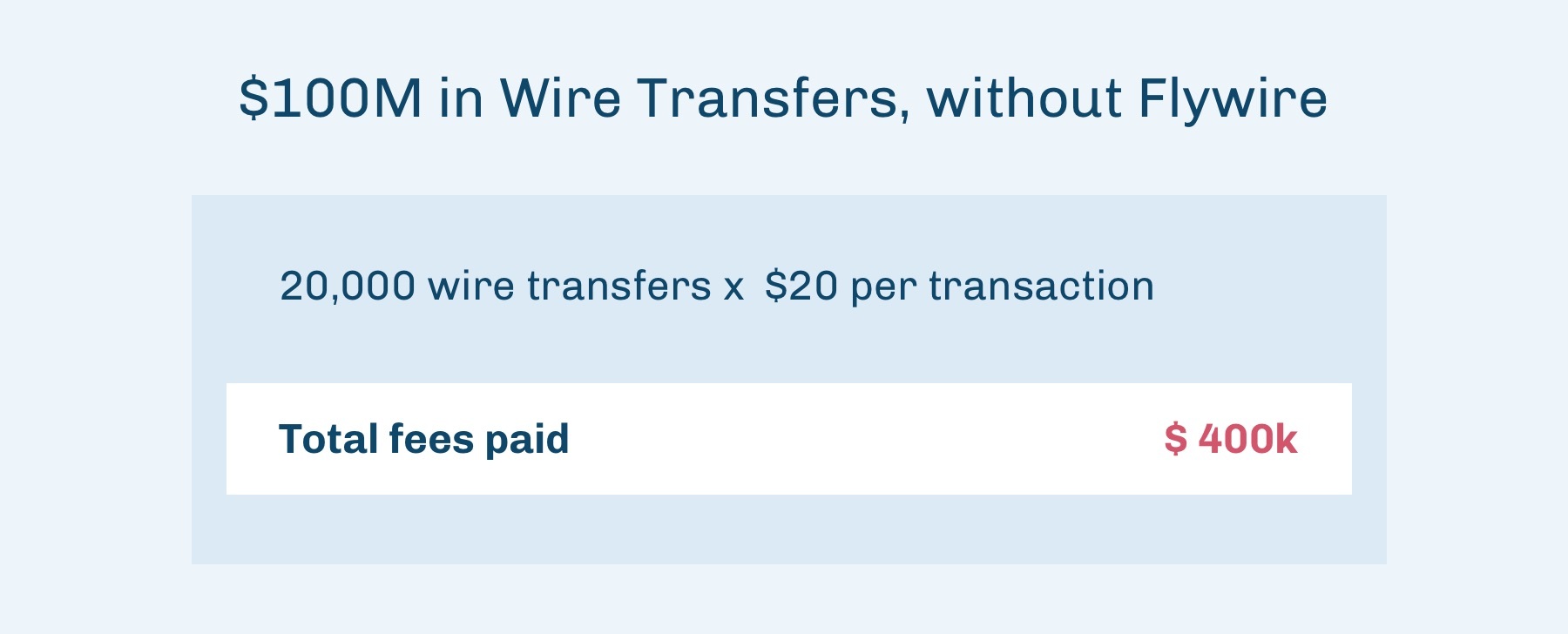

Jones Tech International accepts even more payments via wire transfer. For these transactions, fees are charged on a per transaction basis, regardless of size. Costs vary, but $20 per transaction, charged to the receiver, is typical.

For JTI, we’ll assume 20,000 wire transfers, averaging $5,000 each, resulting in total fees of $400k.

With Flywire

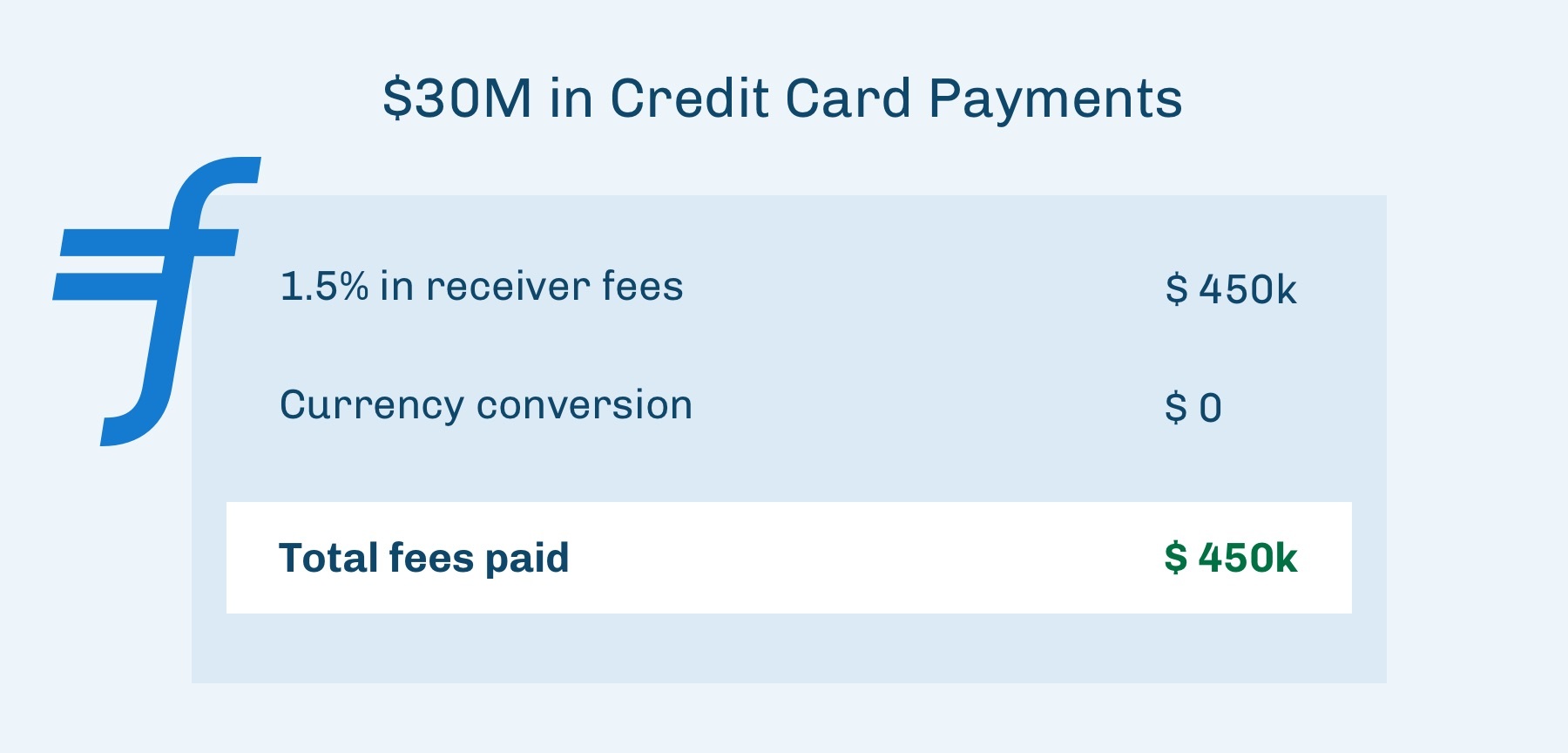

Having moved billions of dollars globally, Flywire has tremendous buying power with our payment partners, like banks, digital wallets, alternative payment methods, and more. This allows us to reduce costs, and pass savings along to our clients. In this example, Flywire can help Jones Tech International reduce the merchant fees on credit card transactions to around 1.5%.

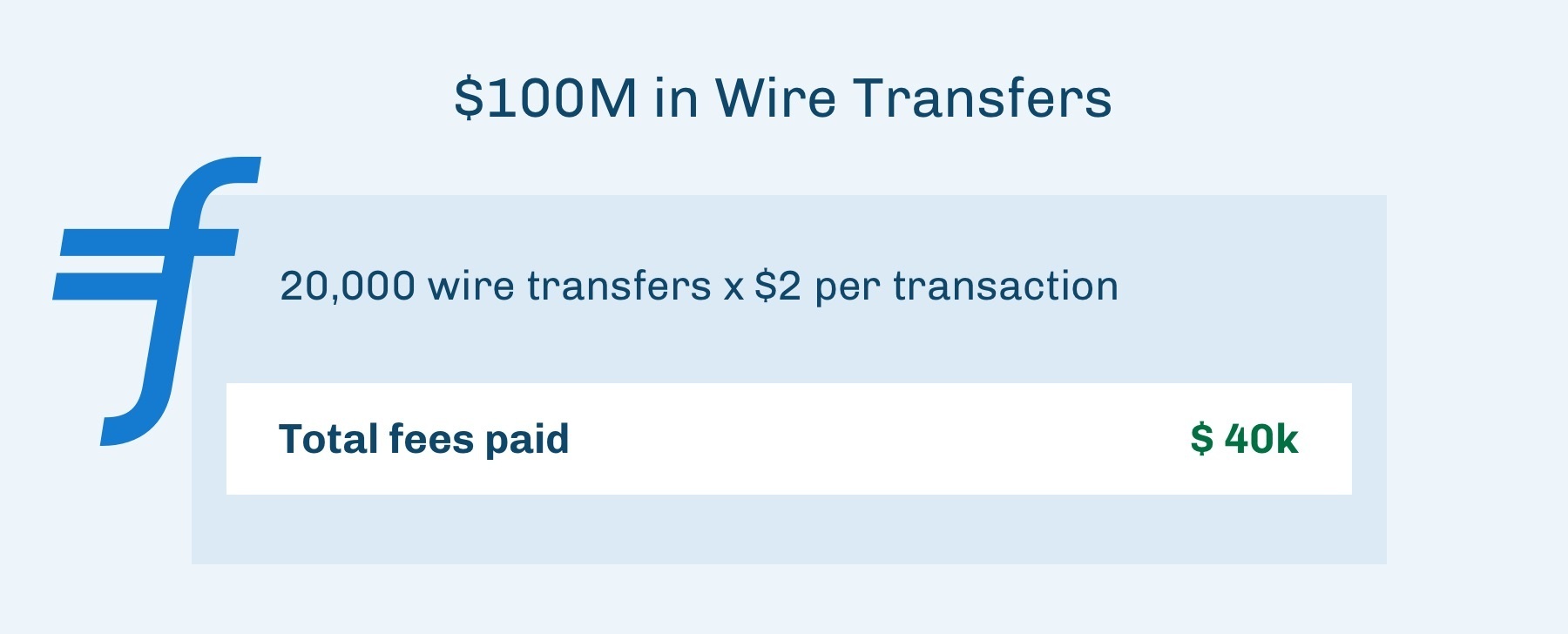

For wire transfers, Flywire accepts payments in the payer’s local currency and pays out to the merchant in their local currency. Dealing in domestic transactions on both sides allows Flywire to lower the total cost of receiving an international wire from $20 to $2.

With international payment fees reduced significantly for both credit card and wire payments, Flywire is able to help clients like JTI make a major impact on the bottom line. In this example, payment fees are reduced by nearly 70% for total savings of over $1.1 million.

The above is a representative example of how Flywire helps our clients save money when receiving B2B payments and every situation will look a little different.

Ready to see how much your business can save?

Request a demo today and we’ll customize a savings estimate based on your own unique business variables.