We recently sat down with Darren Woodward, Flywire’s director of card partnerships, to discuss trends and best practices for the travel industry. Based in London, Darren has had a fascinating career and is instrumental in driving Flywire’s card partnership strategy. As one of Flywire’s amazing thought leaders in the payments space, Darren has advised many of our travel clients. Internally, he helps to inform the ways we provide the best payment experience for our clients in the travel space, as well as their guests.

Q: Darren, you’ve been with Flywire for about two years. How would you describe your role?

A: I look after Flywire’s card scheme relationships and card requirements by ensuring we have the optimal commercial position. I also make certain that we’re in compliance with regulations and laws of the lands, and that we’re are up to date with industry trends such as PSD2. In addition, I ensure that we have the best levels of chargeback and least amount of fraud and we’re operating under best practices throughout Flywire. I also educate our Flymates (our employees) on the cards markets and industry trends.

I got my start in the world of banking at Midland Bank (which was acquired by HSBC), specializing in card payments. I spent many years at HSBC before moving on to Global Payments. Then, I joined Flywire. I’ve been in the card payment space for more than 20 years across banking, card trends, and ecommerce—and I have loved every minute of it.

Q: In the travel space specifically, what are some of the current payment trends you’re seeing?

A: Travel companies want to make card payments as frictionless as possible, while ensuring their guests have all the right options to pay. This broadens beyond just accepting payments from traditional credit card vendors. In order to stay competitive and give payers what they want, travel providers need to enable alternative and local payment types, such as Alipay, PayPal, Trustly, and others. In addition, payment acceptance rates have to be as high as possible without bringing in additional risk of fraud. It is imperative to have the right risk rules in place, as well as technology and tools to monitor and assess for fraud.

Travel is a busy space and highly competitive, which is why businesses in that industry need to provide the strongest offerings and value proposition for their payers. We see a lot of cross-over in the industry, which can often present new challenges. Omni-channel transaction methods, such as e-commerce, telephone, and offline are more and more commonplace offerings now. So, in order to stay competitive and scale, travel providers need to meet their customers where they are.

Q: Can you elaborate on cross-border credit card transactions? What must operators, agencies, and other travel businesses anticipate in terms of fees?

A: Typically, to process a card transaction, fees are determined by the card scheme. Think of your MasterCards and Visas of the world. The type of card, whether it’s a business or personal card, and the location of both the merchant (travel company) and card holder—all of these elements drive the cost of interchange and scheme fees.

For example, a travel merchant in Europe whose payers are outside of that region, may anticipate a fee structure similar to this:

Interchange of consumer card: 1.6%

Scheme fee: 0.8%

Acquirer margin: 0.1-1.0%

Plus gateway fees on top of that.

Let’s break this down a bit further. To understand all of their potential fees, a travel provider must consider each of the following:

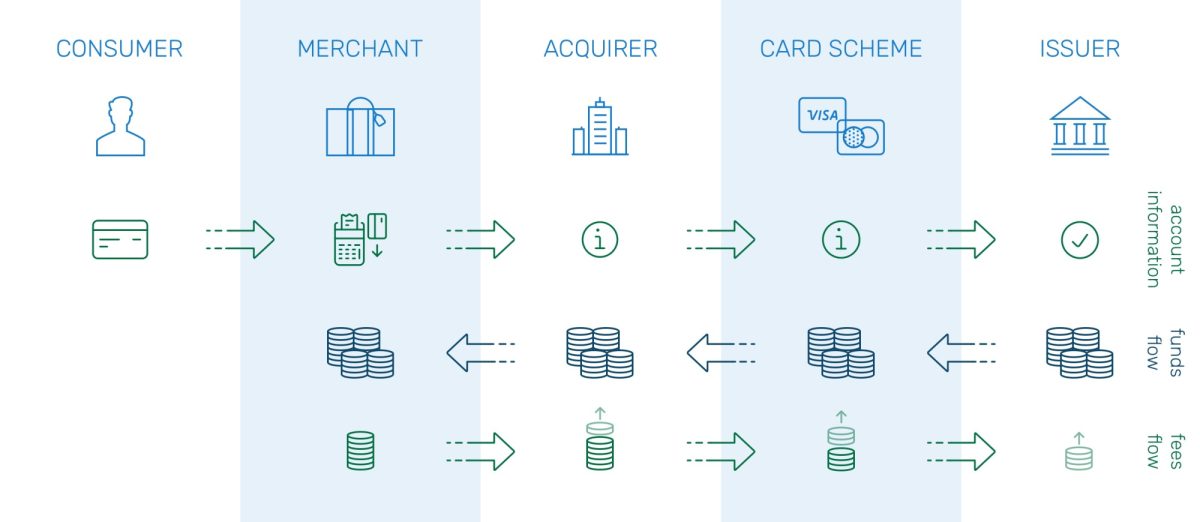

Interchange fees: This fee benefits the card issuer, but is ultimately paid by the travel company. The interchange fee is routed through card acquirer who then transfers it to the credit card network (like MasterCard or Visa) and then, finally, back to the card issuer.

The location of the merchant and the location of the card holder contribute to the interchange fee. For example, if you’re a merchant in Europe, the interchange is regulated for european card holder transactions at a fixed rate. However, if the consumer is outside of Europe, there is a premium interchange charged at approximately 1.6%. In general, the location of the card holder is typically charged at a premium when out of region from where the merchant is.

Ultimately, the location of the merchant and the location of the card holder will drive different levels of interchange. This is important for a travel provider to understand as they set up and plan for costs with payment processing.

Scheme, card acquirer fees, and margin: Scheme fees are applied by the card networks (like MasterCard and Visa) to the acquirers, who then pass it on to the travel company. Acquirer margin is generally determined by volume, the average transaction value, and potentially the risk profile of the merchant. A merchant’s risk profile is determined by the card acquirer, who assess the profile based on trends in the merchant’s payment history and their services delivered.

Travel companies often have higher risk profiles and fees by nature, given the pre-pay nature of many of the businesses. Also, some elements of travel have a higher degree of risk, such as lower cost airlines and budget hotels.

These fees are generally applied on an interchange, plus margin, plus scheme fees basis.

Payment gateway fees: The payment gateway is typically the route into an acquiring platform. The gateway route authorizes and does fraud checking. It also acts as an actual “gateway” to alternate payment methods, such as PayPal, Venmo, and AliPay.

Gateways generally perform tokenization services. That means when your guest provides their card number to pay, the gateway stores it in a secure vault. However, there are fees associated with per-click authorization, as well as the tokenization set-up fee. Alternative payment methods also have their own costs and fees associated, so travel companies should always do their research to understand their gateway’s cost structure.

Q: What are some recommended best practices for travel companies starting or optimizing their payment processes?

A: These are the high-level payment best practices that every travel company should follow:

- Research your fees: Understand the cost base of interchange and scheme fees, and consider whether they can be optimized for the location of your business. It is certainly worth staying abreast of the ongoing EU commission action against MasterCard and Visa as it relates to regulating inter-regional interchange fees and understand how they may change in the future.

- Analyze your acquirer statements: Check, and then double check your acquirer statements to their accuracy and your full understanding of them.

- Always be ready for a credit review: Like any business sending and receiving payments, you will be under constant credit review. Don’t be surprised if you are required by credit acquirers to provide financial information, credit information, and your terms and conditions. Credit acquirers use credit reviews to determine the size of risk and likelihood of the risk being realized—for example, is a company likely to go out of business soon?

- Provide the correct spread of payment types for your payers: Offering payment options that are familiar to your guests will boost acceptance rates and reduce abandonment. This can also potentially reduce your costs while providing a better user experience for your guests.

- Stay informed: Non compliance fees can be steep and losses costly, so stay abreast of payment regulations and any changes to them—specifically PSD2 and PCI. Also, have your acquirer inform you of your requirements around chargebacks and frauds.

Q: In terms of payment experience and managing credit card fees, what do you see as the greatest benefits Flywire provides for clients in the travel industry?

A: There are so many benefits Flywire provides to all of our clients! In my opinion, these are the most valuable ones for the travel businesses we work with:

- Proprietary payments network with verticalized focus: We’ve made it our job to create a positive payment experience for our clients and their payers, while supporting payment options your customers use.

- Reducing friction in the payment process: We make it easy for you to obtain all of the data required to enable payments, so you can receive and reconcile them seamlessly.

- Transparent process: All payments made through Flywire can be tracked by you and your guests. And you can settle and reconcile the funds easily through your Flywire dashboard.

- Secure start to finish: Security is at the heart of everything we do.

- Commercial focus: We enable the optimization of fx flows and the management of processing costs, which allows us to reduce expenses for our clients.