A partnership built to support complex transactions - from setting up initial payments, to managing ongoing royalty fees

FranConnect users can now access Flywire directly within the FranConnect platform for key payment flows – bringing best-in-class payment processing to more than 1,500 brands.

We’re thrilled to partner with Flywire and integrate their B2B payments platform into our marketplace.

Our brands leverage the FranConnect platform for everything from unit sales and territory development, to brand consistency, performance management, and royalty management but a critical missing piece is providing a seamless payment experience, for everything from set-up fees to managing ongoing royalty fees. Flywire enables us to meet that need, and our users will look to their payments capabilities to help them open-up new growth areas both domestically and abroad.

Increase Profitability with Reduced Collection and Payment Reconciliation Time from Over 30 Days to as Little as 1 Day

FranConnect and Flywire's Invoice-to-Pay solution increases your ability to forecast cashflow by eliminating invoicing errors and reducing the Days Sales Outstanding (DSO) – allowing you to open units faster and realizing revenue quicker.

Collect Initial Franchisee Fees (IFF) and Open Units Faster

Collect the Initial Franchise Fee (IFF) and any other upfront investments automatically, online, as soon as a franchise agreement is executed. The payment is facilitated via a seamless integration with Flywire into the FranConnect platform that allows new franchisees to submit their payments via a variety of payment methods and currencies.

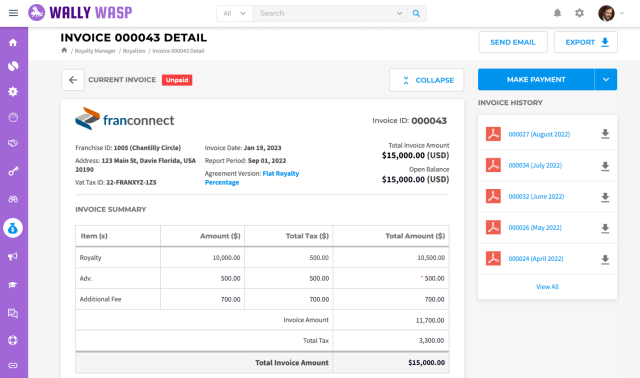

Automate the Royalty Calculation and Payment Collection Process

After collecting the IFF and opening new units, accounting teams can easily import sales into FranConnect’s Royalty Manager to automate the royalty calculation, invoicing, and payment collection process.

- Franchisors get paid faster

- Prevent additional costs and errors associated with manual processing

- Reduce time in manual reconciliation

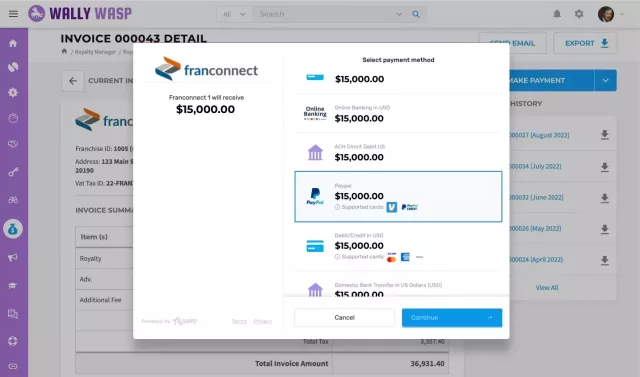

Easy-to-Use Payment Options for the Franchisee

Franchisors can choose to allow franchisees to manually pay invoices or set-up automatic payments on a scheduled basis. Franchisees can easily pay invoices in their local currency and franchisors will receive payment in their desired currency.

- Supports all types of payment methods (ACH, credit card, wire transfers, and alternate payment methods or EFTs).

- Perfect for both domestic and international clients. Offer local payment options and collect in 140+ currencies and 240+ countries.

Unprecedented Transaction Transparency

Franchisors will have a birds-eye view of all invoice and payment statuses, 51% of franchisors say incoming payment visibility is critical for budgeting and managing network capital. Tracking payments can be overwhelming for AR teams, exacerbated by disparate tools and difficult payment networks to maneuver. By integrating ‘Invoice to Pay’ solution, FranConnect can support full invoice and payment lifecycles for franchisors and their franchisees.

Brands experience the following benefits through the Flywire + FranConnect integration

Full visibility into AR payment flow

Shorter collections cycle

Reduction in days sales outstanding

Lower international processing costs

My experience with global remittances before Flywire was characterized by payments being a number of days late, being hit with hidden fees, and managing a difficult reconciliation process.

Working with and incorporating Flywire as the payment option has been a productivity improvement for my partners, as well as a clear path to timely and financial clarity for all involved.

Get a demo

Talk with Flywire’s B2B team today