Outdated payment infrastructure technology is holding back treasury and revenue cycle leaders from aligning on shared priorities to drive predictable patient payment volume. It is a bold statement. But the fact is that payment technology has advanced far beyond what many hospitals and healthcare systems have in place, while their current vendor solutions have remained stagnant.

This current payment foundation in place at many healthcare institutions can not sustain the pace of software-driven payment innovation. The cracks show routinely. A patient is ready to make a payment at the point-of-service, but the point-of-sale terminal is down, and a fix is days away. Or, perhaps, they are ready to act on a payment plan offer, but the payment gateway does not support their preferred digital wallet, such as ApplePay. In the back of their mind, the lack of ease in payment they enjoy in other other aspects of their life introduces doubt over how secure these platforms could actually be, because they seem to be so outdated.

And all of that has a downstream effect on everyone on staff who touches payment processes. Revenue cycle management leaders understand that a reliable and agile payment infrastructure matters in pulling patients across the finish line at the moment they are most likely to make a payment. And treasury leaders are realizing that collections suffer without software-driven payment experiences that build confidence and remove any roadblocks to pay.

How did we get here, and where do we go from here?

Many hospitals and healthcare organizations just accept that things have to run this way – that using the tools provided through their bank and a “household name” gateway provider (perhaps also suggested by their bank) – is a given.

If this sounds like you, here are some cues that outdated payments technology is increasing your cost to collect and stunting more predictable cash flow.

How quickly can you pinpoint a problem with a point-of-sale device when it breaks and get it back up and running?

How seamless are upgrades and updates to point-of-sale devices?

Are all patient payments meeting the lowest scope of PCI compliance - even those taken over the phone?

Can staff quickly provision new point-of-sale devices with the expansion of locations or services?

Is a separate payment system used to handle non-patient fees such as parking or B2B payments like physician credentialing?

Does the payments experience embedded in the EHR portal (such as Epic MyChart or Oracle Health) include functionality beyond the ‘pay button’ – such as personalized outreach to encourage action?

Can you easily provision new payment methods, such as digital wallets, within that embedded payment experience?

Are ecommerce transactions integrated with the back-end EHR system so that they are posted as soon as they are processed?

Do you have a full picture into the fees being tacked on by each vendor handling a part of the payment and want to better manage those costs?

Do your vendors often point fingers at one another while offering no clear solution?

Payment infrastructure built to handle the pace of payment innovation removes friction in those front-end experiences that revenue cycle management leaders have worked hard to enable. The benefits include:

- Cost savings. There are two areas where upgrading payment technology pays off – in fees savings on transactions and in the cost savings achieved by more efficient technology. Cloud-based devices can be remotely monitored, updated and upgraded for more reliable uptime at a more cost efficient price point.

- Faster and more predictable settlement times. Are you waiting as long as a week to settle a payment? All those different payment tech vendors bolted together to process a payment may have different settlement times. With a single payment platform, posting back to the EHR can happen in real-time.

- Save time with automated reconciliation processes. When deposits are coming in from different channels, it is difficult to automate the reconciliation process end-to-end. When matching is automated, your team can instead spend time figuring out why transactions do not match deposits.

- Better uptime and easier upgrades and updates of point-of-sale devices.Payment software development methodology has advanced – and continuous integration and continuous deployment methodology is a much more advanced way to ensure devices remain secure and up-to-date, and minimize downtime.

- Easy to provision new payment methods and support international payments. In a recently-commissioned survey, we found that 42% of Gen Z patients prefer to pay by Google or Apple Pay. Is your bank keeping up here? What’s more, when patients come from other countries for service, their only option is likely bank wire, which is slow, challenging to track and manual to reconcile. Payment platforms ease cross-border transactions, making it easy to see what patients owe in their own currency and enabling payment in that currency.

- Reduce the scope of PCI compliance. When payers want to make payments over the phone, payment platforms bundle cutting-edge security capabilities to ensure hospitals and providers are in compliance with the latest security standards.

A better way to drive volume, reduce costs: Affordability Suite powered by Flywire’s payment services offering

For more than a decade, Flywire has built and run the payment infrastructure that helps people send and organizations receive high-value, high-stakes and complex payments, globally. Flywire has mastered the art of making a cross-border transaction appear as simple as a domestic one to the sender and receiver. We’re the leaders in global payment technology, with experience in ensuring highly secure and efficient payment processing that is in compliance with global payment and data security regulations and standards.

Our full force of payment industry expertise is now available to modernize payment technology and collections for the healthcare space.

The combination of Flywire’s Payment Services and our Affordability Suite software – which offers patients optionality in order to increase their capacity to meet their financial obligations – brings hospitals and healthcare organizations payment technology worthy of the challenges of today’s operating environment, all within a single-vendor environment.

The package integrates to host system EHRs, notably with five Epic-specific integrations in the Epic Showroom as evidence of Flywire’s key partnership, and includes:

Point-of-sale devices

- PCI-validated P2PE payment terminals incorporating swipe, dip, tap and contactless payment methods.

- Tied to specific MIDs, locations, and user accounts for precise tracking and financial clarity at the macro and micro view.

- Staff users can easily setup and manage payment devices, reducing the need for manual support.

Leading payment processing platform

- Support for all card payments, ACH, digital wallets, cash and international payments from 240+ countries in 140+ currencies

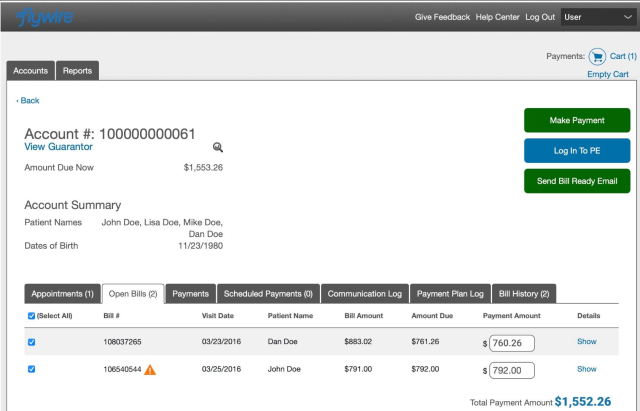

- Supports saved payment methods, including secure credit card data storage, to automate payment plans and scheduled payments for patient convenience.

- Automatically keeps card details current for recurring payments increasing the successful completion rate of payment plans.

- Baked-in compliance and cutting-edge KYC processes, for the highest levels of payment security.

- Chargeback and return management, integrated directly into the platform and automatically updating the patient account balance in the host system.

Flywire patient engagement and affordability software

- Payments - digital-first, AI-enabled patient engagement that encourages action and self-service to reduce staff involvement.

- Short-term payment plans - short-term offers to increase self-pay collections.

- Integrated financing for longer-terms payment plans - allows healthcare systems to offload higher-risk receivables by offering longer-term, zero-interest, non-recourse financing and payment plans directly within the payment portal to patients who need more than 12 months to pay.

Epic Showroom listings

- EMV device integration, part of Epic Toolbox, to easily set up and capture payments in Epic Hyperspace, Welcome and Willow.

- Secure Checkout. With Flywire’s External Payment page, patients can pay directly in MyChart, and providers decrease the scope of PCI compliance to ensure more secure payment processing.

- SSO in MyChart. Patients access the Flywire payment experience, and the expanded payment options it brings, directly in MyChart.

- Flywire SSO in Resolute. Staff can access Flywire within the familiar billing and revenue cycle management experience to set-up and manage payment plans.

- Real-Time Payments. Because transaction information is integrated with Epic, payments are posted in the system as soon as they are processed.

The combination of software and payment services helps providers leverage industry-leading payment technology in a single-vendor environment to improve collection performance and decrease costs.

Are you ready to innovate?

Learn more about Flywire Payment Services